32+ Easy mortgage payment calculator

Use the popular selections weve included to help speed up your calculation a monthly payment at a 5-year fixed interest rate of 5540 amortized over 25 years. The mortgage amount rate type fixed or variable term amortization period and payment frequency.

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your.

. Compare mortgage terms payment options rates and more. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. Dont worry you can edit these later.

The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont.

The USDA Loan Calculator has options for property tax home insurance payment frequency monthly and bi-weekly monthly HOA fees and extra payments with a printable amortization schedule. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. The cost of borrowing the money.

Yes its possible to get a 40-year mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Can you get a 40-year mortgage.

Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. How much youll pay is indicated by your interest rate. Use our easy calculator to get the information you need to put you in a stronger position to negotiate with the seller and to create the right budget for you while also buying the home of your dreams.

To use it all you need to do is. Advantages of 30-Year Home Loans. Lenders Mortgage Insurance Calculator Capital Gains Tax Extra Lump Sum Payment Calculator Mortgage.

This lower payment in turn makes it easier for home buyers to qualify for a larger loan amount. The above calculations consider the capital and interest portion of the mortgage payment but do. Try this tool Created with Sketch.

Please be aware that this is only an indication of how much you could borrow. Heres what typically makes up a mortgage payment. An easy way to pay your loan off faster is by making extra repayments into your loan.

On a 30-year jumbo mortgage the average rate is 5. PMI vs 2nd Mortgage. Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. The mortgage payment calculator can give you a reality check on how much you can expect to pay each month especially when considering all the. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

Mortgage comparison calculator Mortgage prepayment calculator. 2332 were loans to first-time homebuyers 1115 were for buy-to-let mortgages and 3960 was classified as other. The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment.

If you opt to use an escrow account or your lender requires it youll also have your property taxes mortgage insurance and homeowners. This money is applied straight to your loan balance. While the most common and widely used mortgages are 15- and 30-year mortgages lenders can and do offer a wide variety of payment termsFor example a borrower looking to pay off their home quickly may consider a 10-year loanOn the other hand a buyer seeking the lowest.

The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment. USDA Mortgage Calculator with taxes and insurance to calculate USDA loan payments. Help With Our Mortgage Balance Calculator.

Enter the original Mortgage amount or the last mortgage amount when remortgaged Enter the monthly payment you make. Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. Compare your mortgage options with easy to use tools and calculators.

3443 W 17th Ave Spokane Wa 99224 Mls 202221778

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

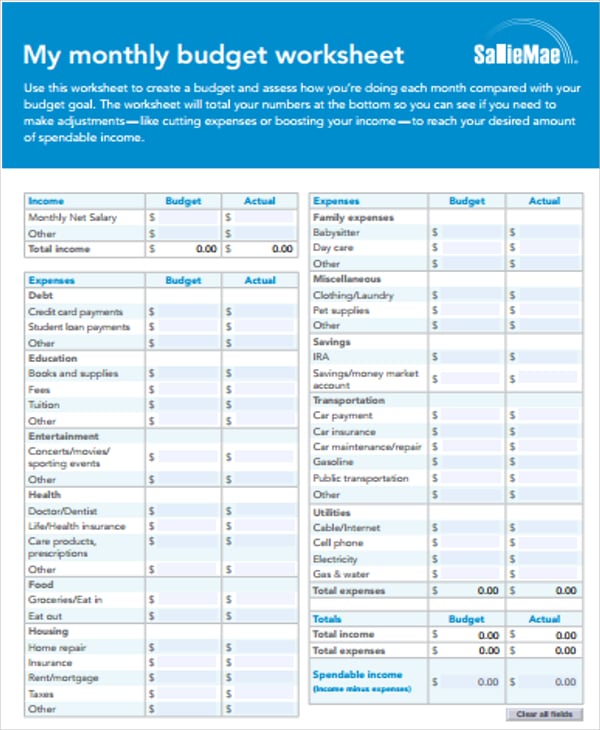

32 Expense Sheet Templates In Pdf Free Premium Templates

Residential Construction Budget Template Excel Inspirational 15 Bud Spreadsheet Exc Household Budget Template Budget Planner Template Budget Template Printable

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

Egret Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

506 S Margaret St Deer Park Wa 99006 Realtor Com

18315 E 11th Ave Greenacres Wa 99016 Mls 202118493 Zillow

Kinglet Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

3117 W Hartson Ave Spokane Wa 99224 Mls 202119601 Zillow

Rbcy Croorxmfm

Egret Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

815 E Brady Ave Spokane Wa 99208 Mls 202216861 Trulia

1015 S Ventura Ln Medical Lake Wa 99022 Mls 202218960 Trulia

21644 Hodge Road Waverly Mo 64096 Compass

Blake Platform Storage Bedoak Wood Platform Bed Frame Solid Wood Platform Bed Wood Platform Bed